Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Fund Manager OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Fund Manager to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Fund Manager OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

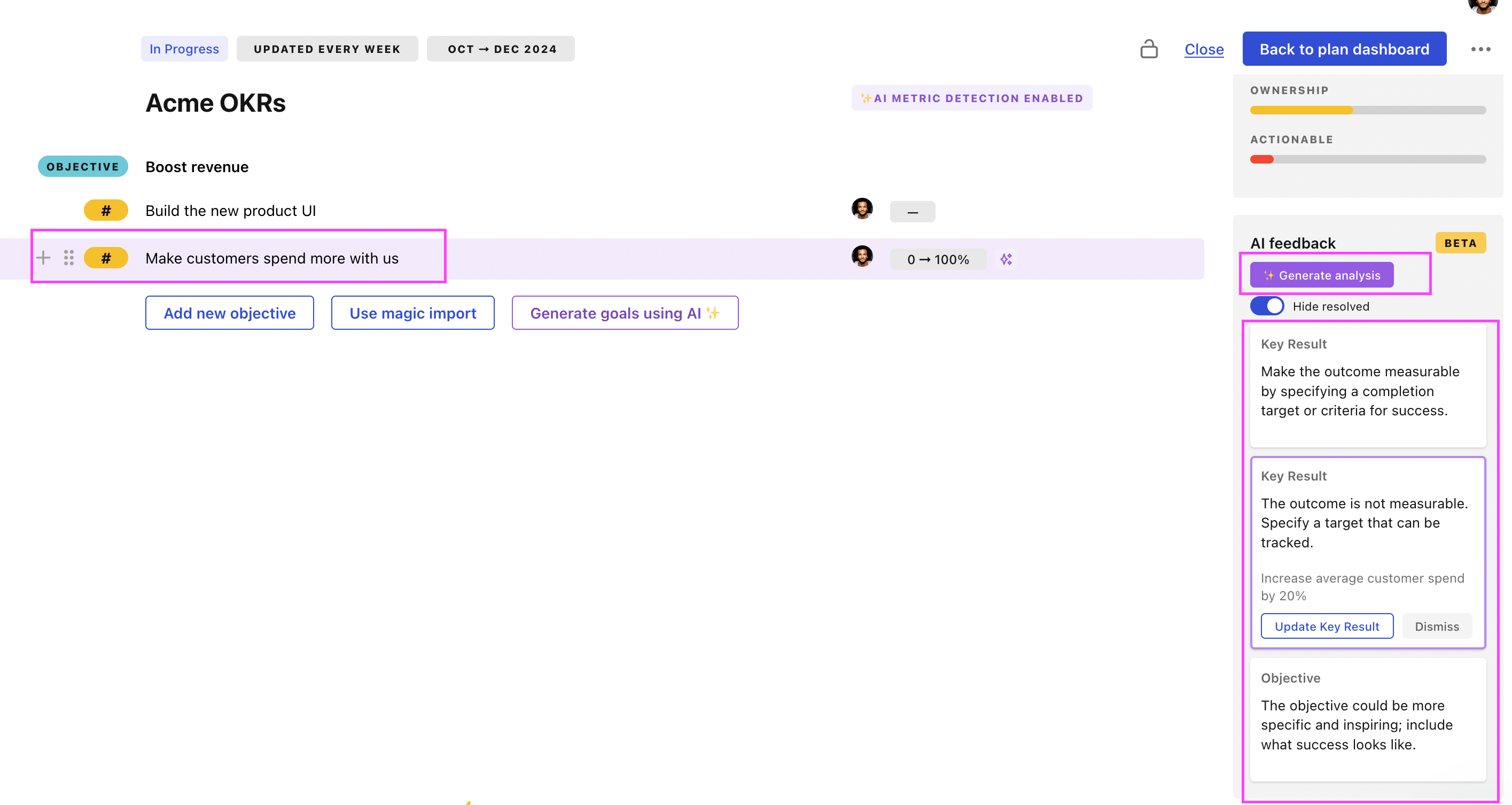

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Fund Manager OKRs examples

You will find in the next section many different Fund Manager Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to radically boost fundraising efficacy and secure debt and equity

ObjectiveRadically boost fundraising efficacy and secure debt and equity

KRSecure equity investment of $2 million through pitches to potential investors

Identify and research high-net-worth potential investors

Schedule and prepare engaging investment pitches for those investors

Create a compelling, detailed business plan for potential investors

KRIncrease the fundraising amount by 30% through targeted campaigns

Research potential donors and their interests for targeted appeals

Develop compelling campaign messaging to attract higher donations

Implement a personalized outreach strategy to potential high-value donors

KRSecure $1 million in low-interest debt financing from financial institutions

Prepare a compelling loan application emphasising repayment capability

Schedule and organize meetings for negotiation with institutions

Research and identify potential financial institutions for low-interest debt financing

OKRs to strengthen and empower the digital fundraising team

ObjectiveStrengthen and empower the digital fundraising team

KRIncrease team fundraising project executions by 30%

Develop a comprehensive training program for fundraising strategies

Optimize current fundraising processes for increased efficiency

Encourage collaborations within teams for fundraising projects

KRRaise team's digital literacy skill levels by 25%

Implement regular training sessions on relevant digital tools

Assess current digital literacy and identify areas for improvement

Provide resources for self-paced online learning

KRDecrease project delivery timelines by 15%

Implement effective project management software

Streamline approval and decision-making processes

Enhance team communication and collaboration

OKRs to maximize funding for Corporate Social Responsibility (CSR) initiatives

ObjectiveMaximize funding for Corporate Social Responsibility (CSR) initiatives

KRAchieve 80% of staff participation in company-wide CSR fundraisers

Implement incentives for participating in CSR fundraisers

Design engaging CSR fundraiser activities to encourage participation

Communicate the importance and impact of CSR fundraisers to staff

KRIncrease CSR budget allocation by 25% from last quarter

KRSecure at least 3 new partnerships for CSR funding by quarter end

Identify potential partners aligned with our CSR goals

Reach out to and pitch to 5 organisations every week

Follow-up and secure agreements with interested prospects

OKRs to expand the reach of our nonprofit organization

ObjectiveExpand the reach of our nonprofit organization

KRBoost fundraising revenue by 30% through improved campaigns and donor retention

Evaluate, improve, and maintain the donor retention strategy

Implement a personalized approach to donor communication and engagement

Develop compelling storytelling for fundraising campaigns

KRIncrease the number of active volunteers by 20%

Improve the volunteer onboarding process

Launch a recruiting campaign targeting community engagement

Develop an attractive volunteer benefits package

KRSecure 5 new partnerships for collaborative projects and events

Negotiate and finalize partnership contracts

Identify potential partners in alignment with project goals

Initiate outreach to selected prospects for collaboration

OKRs to successfully launch a venture capital fund

ObjectiveSuccessfully launch a venture capital fund

KRIdentify and establish connections with at least 50 potential portfolio startups

Set up follow-up meetings with interested startups

Send introductory emails to identified startups

Research contact details of potential portfolio startups

KRSecure investment commitments worth $20 million from initial seed investors

Research and identify potential seed investors

Arrange meetings with prospective investors

Craft business proposal highlighting potential returns

KRSet up legal and compliance standards for fund operations

Identify relevant local and international laws for fund operations

Develop a comprehensive compliance framework addressing these laws

Train employees on new legal and compliance standards

OKRs to successfully raise $2M at an upcoming fundraising event

ObjectiveSuccessfully raise $2M at an upcoming fundraising event

KRObtain corporate sponsorships adding to $750K

Identify potential corporations interested in sponsoring your organization

Craft a dynamic, tailored sponsorship proposal for each corporation

Arrange meetings to pitch sponsorship opportunities and benefits

KRSecure pledges from 10 major donors contributing $500K collectively

Identify and list potential major donors

Facilitate meetings to discuss pledges

Develop personalized proposals for each donor

KRAttract 1,000 event attendees at $500 donation per ticket

Leverage partnerships for greater visibility and reach

Develop targeted marketing strategies to reach potential donors

Organize high-value perks and incentives for attendees

OKRs to raise 1 Million US Dollars as seed funding

ObjectiveRaise 1 Million US Dollars as seed funding

KRIdentify and pitch to 50 potential investors in targeted industries

Create a comprehensive list of 50 potential investors in targeted industries

Research each investor's interests, prioritizing those aligned with our company

Develop and customize pitches tailored to each potential investor

KRSecure commitments from 10 investors at an average of $100,000 each

Schedule individual meetings to present pitch

Identify 20 potential investors for initial outreach

Prepare a persuasive investment pitch

KRExecute fundraising events/campaigns generating $200,000 in total

Organize high-donor events and peer-to-peer fundraising campaigns

Implement donor stewardship plan to encourage repeat contributions

Develop a comprehensive fundraising strategy targeting a $200,000 goal

OKRs to secure $1 million for the pre-seed funding round

ObjectiveSecure $1 million for the pre-seed funding round

KRIdentify and reach out to 50 potential investors by end of phase 1

Initiate contact with each investor through personalized emails

Research and locate contact information for identified investors

Identify 50 potential investors using business directories or networking

KRAchieve commitment for investment from minimum 50% met investors by final phase

Negotiate and finalize investment commitments from participating investors

Create a compelling presentation for potential investors

Schedule and conduct regular meetings with interested investors

KRSecure meetings with at least 25% of identified investors by phase 2

Create a persuasive investment proposal

Schedule and arrange meetings with identified investors

Identify and research potential investors for pitching

OKRs to expand investor network with five strategic VC firms

ObjectiveBuild relationships with 5 top VC firms

KRAttend 2 industry events hosted by each VC firm

KRArrange meetings with decision makers from 5 VC firms

KRSecure 3 introductions to portfolio companies from each VC firm

KRCollect and analyze data on 10 potential leads from each VC firm

OKRs to achieve $50million in IIMAX interval Fund Sales

ObjectiveAchieve $50million in IIMAX interval Fund Sales

KRSecure 5 large-scale investments totalling $25 million

Identify and categorize potential investors in the sector

Prepare detailed, attractive investment proposals

Schedule and conduct persuasive pitching sessions

KREnhance customer satisfaction by 20% to encourage referral sales

Implement thorough training for customer service representatives

Solicit customer feedback to improve products/services

Launch a loyalty program rewarding regular customers

KRIncrease outreach to potential investors by 30%

Launch targeted social media ad campaigns for investor engagement

Participate in relevant industry networking events

Enhance investment proposal presentations for clarity and appeal

Fund Manager OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

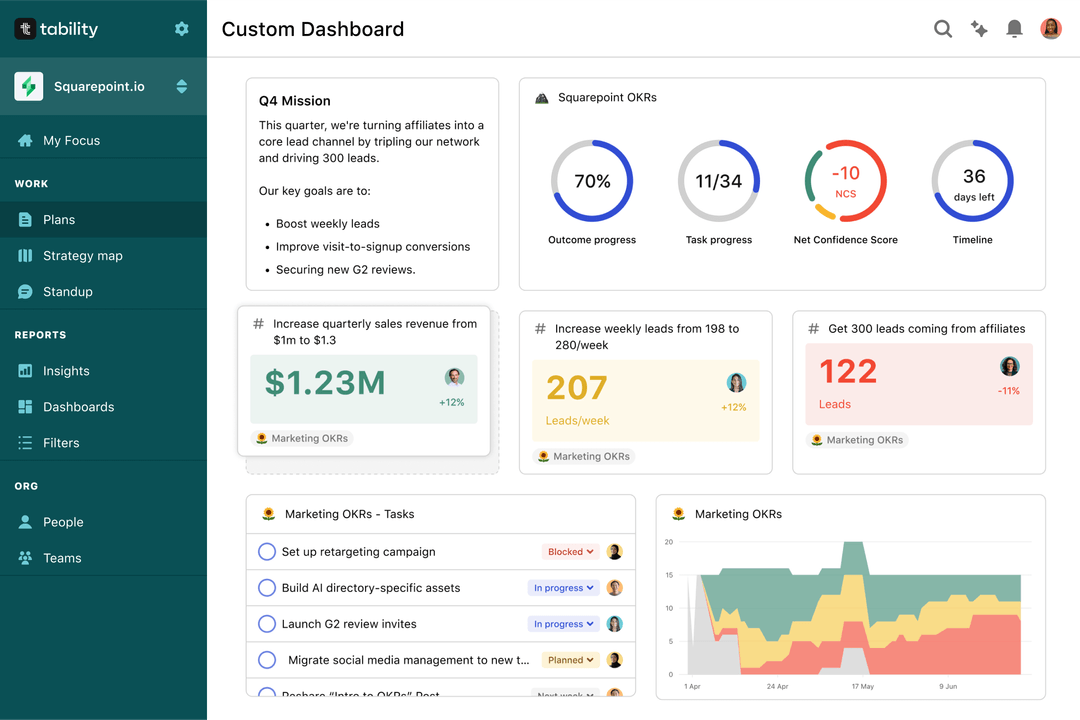

Save hours with automated Fund Manager OKR dashboards

Quarterly OKRs should have weekly updates to get all the benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Fund Manager OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance stakeholder and senior management communication

OKRs to improve user satisfaction through comprehensive training

OKRs to implement comprehensive, multi-disciplinary colour testing

OKRs to enhance customer satisfaction for our SaaS product

OKRs to successfully achieve pipeline target of $10,000,000

OKRs to increase inbound discovery calls through an evergreen funnel test