Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Accountant OKRs?

The Objective and Key Results (OKR) framework is a simple goal-setting methodology that was introduced at Intel by Andy Grove in the 70s. It became popular after John Doerr introduced it to Google in the 90s, and it's now used by teams of all sizes to set and track ambitious goals at scale.

Creating impactful OKRs can be a daunting task, especially for newcomers. Shifting your focus from projects to outcomes is key to successful planning.

We have curated a selection of OKR examples specifically for Accountant to assist you. Feel free to explore the templates below for inspiration in setting your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Accountant OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

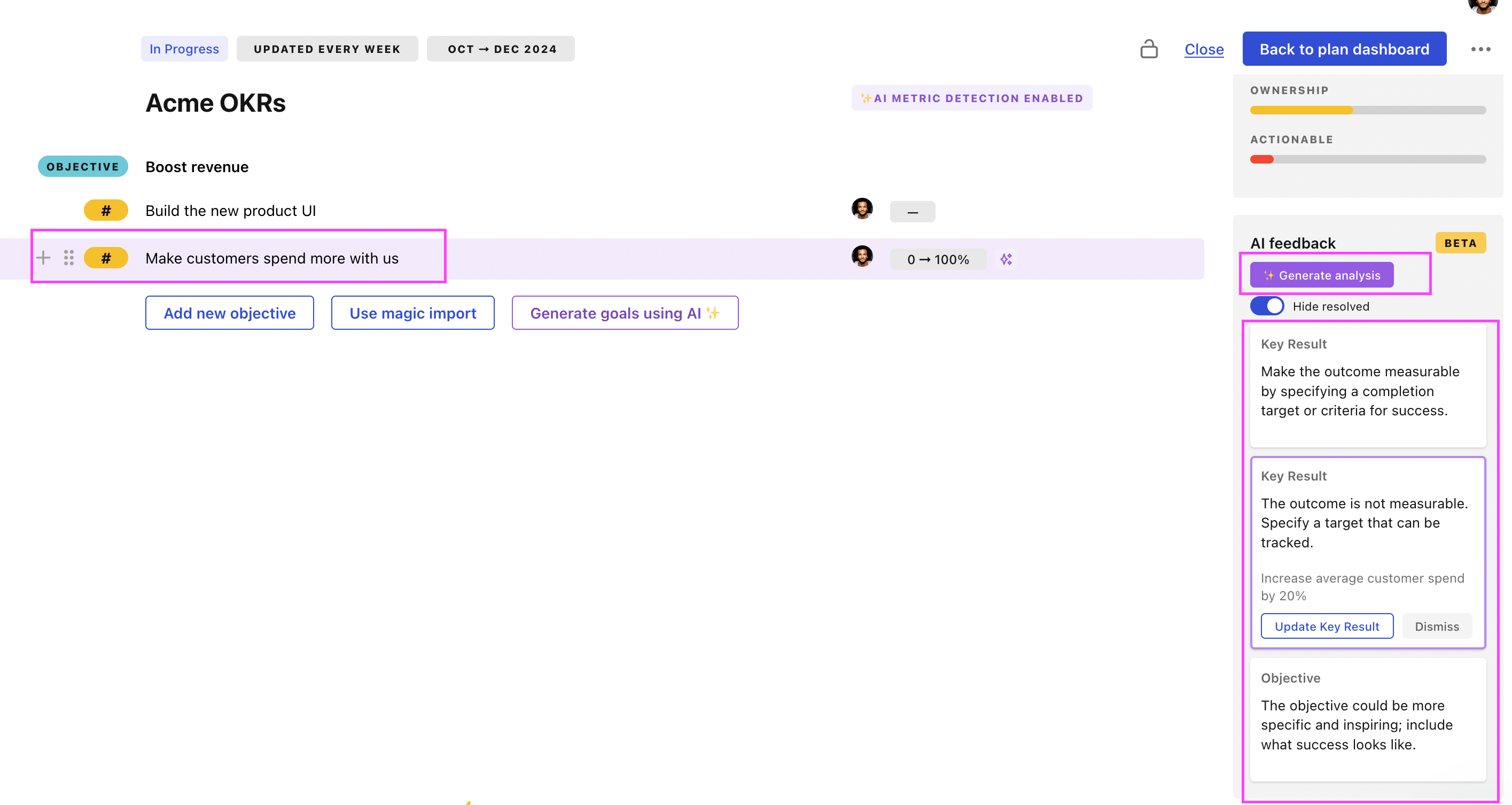

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Accountant OKRs examples

We've added many examples of Accountant Objectives and Key Results, but we did not stop there. Understanding the difference between OKRs and projects is important, so we also added examples of strategic initiatives that relate to the OKRs.

Hope you'll find this helpful!

OKRs to achieve full productivity as a General Accountant

ObjectiveAchieve full productivity as a General Accountant

KRReduce weekly accounting errors by 50%

Implement thorough double-checking procedures for all accounting tasks

Provide additional training on accounting software usage

Instantly address and correct identified accounting errors

KRScore at least 90% on internal accounting knowledge assessments

Study company's internal accounting policies daily

Practice with past assessment tests for improvement

Seek clarifications for any accounting concepts not understood

KRIncrease speed of invoice processing by 30%

Train staff in efficient invoice processing techniques

Streamline invoice approval process

Implement automation software for quick invoice management

OKRs to enhance product suite experience for small businesses and accountants

ObjectiveEnhance product suite experience for small businesses and accountants

KRImprove user interface navigation by 35% measured by user testing

Implement interface changes based on feedback

Conduct user testing to measure improvement

Survey users for feedback on current navigation difficulties

KRImplement 2 new features based on users' unique needs surveys feedback

Test and implement the new features

Analyze survey feedback to identify two most requested features

Design and develop these two new features

KRReduce customer support calls by 30% through enhanced, intuitive design

Implement intuitive, user-friendly features

Improve user interface for easier navigation

Incorporate a comprehensive FAQ section

OKRs to boost efficiency in preparing financial statements

ObjectiveBoost efficiency in preparing financial statements

KRDecrease statement errors by 20% through improved training and software implementation

Regularly evaluate and update statement production methods

Implement in-depth training sessions on statement generation

Procure advanced software for accurate statement production

KRReduce financial statement preparation time by 15% from its current average

Streamline data collection procedures for efficiency

Train team on efficient financial statement preparation skills

Implement automated accounting software for faster data processing

KRImplement a new financial statement software to automate at least 50% of tasks

Research and select the most suitable financial statement software

Monitor and evaluate software's effectiveness regularly

Train employees on how to use this new software

OKRs to achieve 100% productivity in financial statement preparation

ObjectiveAchieve 100% productivity in financial statement preparation

KRIncrease financial statement preparation speed by 20% without errors

Implement automated accounting software for faster data processing

Streamline and simplify the financial reporting process

Conduct regular training on accurate and quick data entry

KRImplement an effective workflow to process all financial reports within schedule

Implement regular check-ins to monitor progress

Establish clear deadlines for all financial report processes

Assign specific tasks to designated team members

KRAttain absolute accuracy in 95% of prepared financial statements, as assessed by audits

Establish comprehensive training for finance team

Implement strict quality control in financial reporting

Conduct regular internal audits for immediate correction

OKRs to within budget

ObjectiveMaintain expenses within budget

KRAchieve 90% accuracy in budget forecasting

KRIncrease departmental efficiency by 15%

KRDecrease variable expenses by 10%

KRImplement cost-cutting initiatives resulting in a 5% reduction in fixed expenses

OKRs to enhance precision and productivity of tax and accounting operations

ObjectiveEnhance precision and productivity of tax and accounting operations

KRReduce bookkeeping errors by 20% through the introduction of automation software

Train employees to use the new software efficiently

Research and select suitable bookkeeping automation software

Implement chosen automation system into daily operations

KRCondense tax computation time by 30% via process optimization

Implement efficient tax software to streamline computations

Regularly update tax computation best practices

Allocate more resources to data compilation

KRAchieve 15% rise in overall productivity by training staff in new methodologies

Identify relevant training programs for new methodologies

Arrange and schedule training for staff members

Monitor and assess improvements in productivity post-training

OKRs to achieve full productivity in general accounting role

ObjectiveAchieve full productivity in general accounting role

KRComplete 100% of assigned tasks accurately and on time

Regularly review progress and adjust plans as needed

Allocate sufficient time daily for each assignment

Prioritize tasks based on urgency and relevance

KRIncrease efficiency by automating 2 routine accounting processes

Identify two repetitive accounting tasks prone to human error

Research and select relevant automation software

Implement and test the selected automation system

KRReduce error rate in accounting tasks by 50%

Train staff in latest accounting procedures and software

Implement a double-check system for all accounting tasks

Regularly review and correct errors in accounting records

OKRs to improve efficiency in meeting accounting deadlines

ObjectiveImprove efficiency in meeting accounting deadlines

KRAchieve 100% on-time completion for end-of-month reconciliation

Perform weekly audits to maintain accuracy and timeliness

Assign specific roles and timelines to the team

Implement a daily monitoring system for all reconciliation tasks

KRIncrease early completion rate by 10%

Streamline processes for quicker completion

Provide efficient training to improve early completion skills

Implement rewards for tasks completed ahead of schedule

KRReduce late submission of reports by 20%

Introduce penalties for late report submissions

Regularly remind team about upcoming report due dates

Implement strict deadlines for submission of reports

OKRs to successfully finish financial statement within the required timeline

ObjectiveSuccessfully finish financial statement within the required timeline

KRFinalize and review financial statement for completion by the fifth working day

Compile all necessary financial data

Draft the financial statement

Review and finalize the financial statement

KRAccumulate all necessary financial data within the first 2 working days

Gather data from online financial systems and reports

Compile and organize all collected data

Identify required financial data and relevant sources

KRDraft preliminary financial statement by the third working day

Review and finalize the draft by the third working day

Begin creating a draft of the financial statement

Gather all necessary financial documents and data

Accountant OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

Having too many OKRs is the #1 mistake that teams make when adopting the framework. The problem with tracking too many competing goals is that it will be hard for your team to know what really matters.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Setting good goals can be challenging, but without regular check-ins, your team will struggle to make progress. We recommend that you track your OKRs weekly to get the full benefits from the framework.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

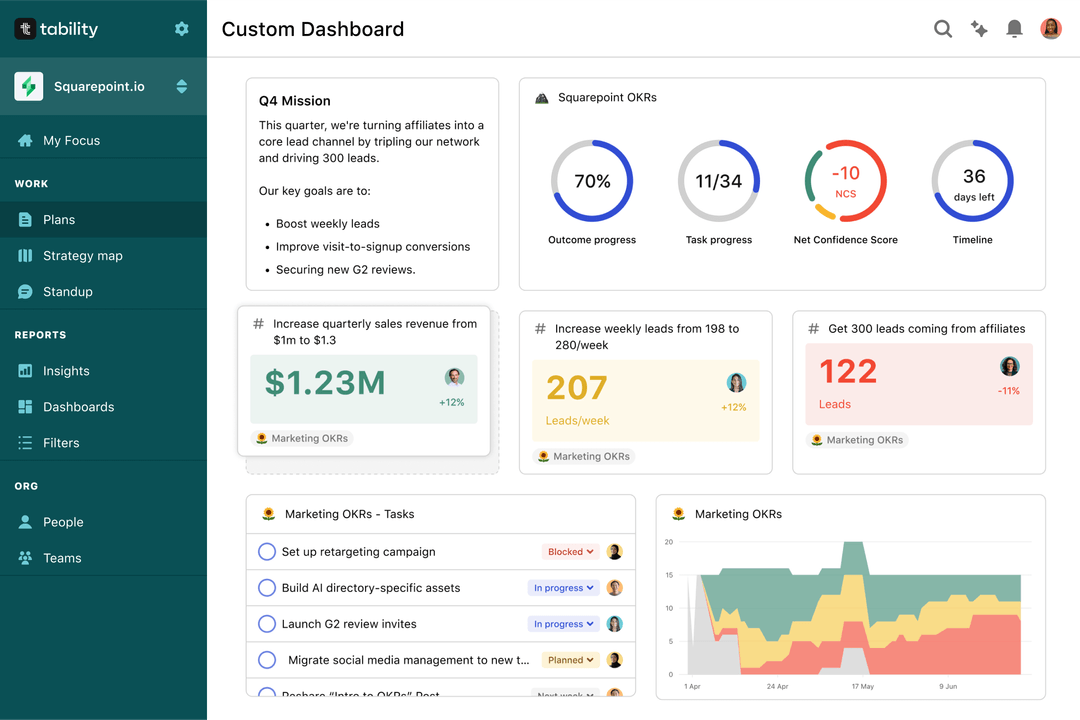

Save hours with automated Accountant OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

We recommend using a spreadsheet for your first OKRs cycle. You'll need to get familiar with the scoring and tracking first. Then, you can scale your OKRs process by using Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Accountant OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance auditing of homeowner communication and calls

OKRs to improve website's SEO performance and user engagement

OKRs to raise 1 Million US Dollars as seed funding

OKRs to improve product excellence and expedite shipping

OKRs to establish a robust, efficient new financial structure

OKRs to acquire new clients providing a security deposit