Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Investment Team OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Formulating strong OKRs can be a complex endeavor, particularly for first-timers. Prioritizing outcomes over projects is crucial when developing your plans.

We've tailored a list of OKRs examples for Investment Team to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Investment Team OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

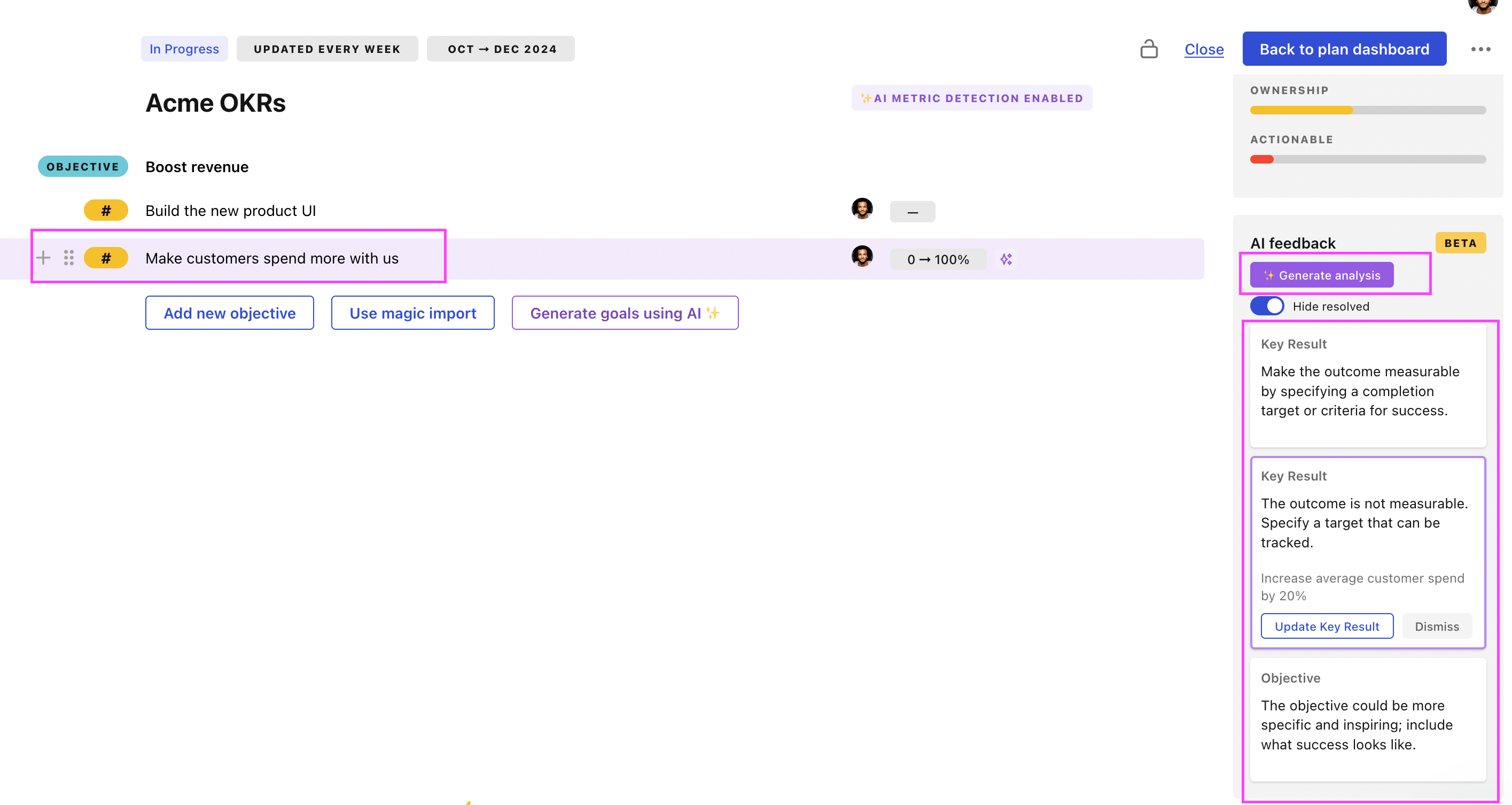

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Investment Team OKRs examples

You'll find below a list of Objectives and Key Results templates for Investment Team. We also included strategic projects for each template to make it easier to understand the difference between key results and projects.

Hope you'll find this helpful!

OKRs to secure additional significant investment for our basketball team

ObjectiveSecure additional significant investment for our basketball team

KRFinalize and secure financing from at least one new major investor

Set up and conduct meetings with prospective financiers

Compile a comprehensive proposal for potential investors

Finalize agreements and secure the investment

KRPitch investment opportunity and potential returns to 15 interested investors

Craft compelling investment opportunity presentation with potential returns

Identify and contact 15 potential investors for pitching

Schedule and conduct investment pitches

KRIdentify and build relationships with at least 20 potential major investors

Research and create list of 20 potential major investors

Organize meetings to discuss investment opportunities

Initiate contact with investors via emails or calls

OKRs to identify high-potential startups for potential investment

ObjectiveIdentify high-potential startups for potential investment

KRAttend or participate in a minimum of 3 startup pitch events to expand network and discover new opportunities

Register and RSVP for the chosen startup pitch events

Engage with fellow entrepreneurs and exchange contact information for future collaboration

Prepare a concise pitch to present at the startup pitch events

Research upcoming startup pitch events in the local area

KRResearch and evaluate a minimum of 20 startups with innovative and scalable business models

Conduct thorough research on each startup's business model and scalability

Create a report summarizing the findings and key insights from the research

Compile a list of 20 startups with innovative business models

Evaluate the potential of each startup based on identified criteria

KRConduct thorough due diligence on at least 10 startups, assessing financials, market potential, and team

Investigate the background and expertise of the team members in 10 startups

Summarize the findings of due diligence in concise reports for each startup assessed

Research and analyze the financial statements of 10 startups for detailed assessment

Evaluate the market potential of 10 startups through market analysis and potential growth opportunities

KREstablish partnerships with at least 2 trusted venture capitalists or angel investors for knowledge-sharing and potential co-investment opportunities

Reach out to the selected venture capitalists or angel investors to express interest in collaboration

Research and identify potential venture capitalists or angel investors with established credibility

Set up meetings or calls with the identified partners to discuss knowledge-sharing and co-investment opportunities

Establish formal agreements and partnerships with the selected venture capitalists or angel investors

OKRs to analyze investment performance across different regions

ObjectiveAnalyze investment performance across different regions

KRDeliver a detailed investment performance report comparing all regions

Analyze and compare investment performance by region

Compile and format the detailed performance report

Collect data on investment performance for all regions

KRIdentify top 5 performing and under-performing regions by next month

Gather sales data from all regions

Analyze and rank regions based on performance

Prepare detailed comparative report

KREvaluate 10 distinct factors that influence the performance in each region

Identify 10 potential factors affecting regional performance

Analyze each factor's impact on the specific region

Compile findings into a comprehensive report

OKRs to strategically invest $25,000 to yield 15% annual returns

ObjectiveStrategically invest $25,000 to yield 15% annual returns

KRCommit $12,500 to diversified mutual or index funds for steady long-term growth

Select a range of mutual or index funds

Regularly monitor fund performance

Allocate $12,500 across chosen funds

KRAllocate $6,250 to high-value stocks with a history of consistent returns

Determine $6,250 investment distribution

Identify high-value stocks with consistent returns

Execute allocation towards identified stocks

KRAssign $6,250 to bonds or other secure investments to hedge against potential losses

Research and identify secure investment options

Decide on bonds or alternative secure investments

Allocate $6,250 towards chosen investments

OKRs to deliver a well-informed assessment for a potential Series A follow-on investment at XY GmbH

ObjectiveDeliver a well-informed assessment for a potential Series A follow-on investment at XY GmbH

KRComplete a comprehensive risk-benefit analysis of the follow-on investment

Identify and evaluate potential risks and benefits

Compile and summarize analysis data in a final report

Gather all relevant data pertaining to the follow-on investment

KRAnalyze XY GmbH's financial performance of the past two years

Compare financial KPIs year-on-year to determine performance

Identify notable trends or outliers in financial data

Gather XY GmbH's financial statements from the past two years

KREvaluate competitiveness in XY GmbH's market sector

Review customer satisfaction surveys and online reviews about XY GmbH's services

Analyze XY GmbH's product positioning and pricing against competitors

Conduct a SWOT analysis specific to XY GmbH's market sector

OKRs to identify high-growth potential public companies for investment

ObjectiveIdentify high-growth potential public companies for investment

KRInvest in top 10 high-performing companies from the analyzed list

Allocate investment funds towards these companies

Research and identify top 10 high-performing companies

Analyze their financial stability and growth potential

KRAnalyze financial reports of shortlisted companies to confirm revenue growth

Identify and calculate each company's revenue growth

Compare and contrast the revenue growth among companies

Gather financial reports of selected companies

KRResearch and shortlist 50 public companies with over 20% earnings growth

Identify 50 public companies using market research platforms

Shortlist those with over 20% earnings growth

Analyze their financial records for earning growth

OKRs to scale the startup to achieve unicorn status

ObjectiveScale the startup to achieve unicorn status

KRExpand customer base by acquiring 100 new clients

Identify target market segments and prioritize based on potential revenue and fit

Develop targeted marketing campaigns to attract potential clients from identified segments

Establish strategic partnerships with complementary businesses to leverage their customer base

Implement referral program to encourage existing clients to refer friends and colleagues

KRsecure $10 million in funding from investors

Identify and approach potential investors with a tailored and persuasive investment proposal

Develop and demonstrate a solid growth strategy and execution plan to convince investors

Create a compelling pitch deck highlighting the market potential, competitive advantage, and financial projections

Conduct thorough due diligence to ensure investors' trust by providing accurate financial information and projections

KRIncrease monthly revenue by 30%

KRAchieve a user retention rate of 80%

Implement personalized notifications and incentives to encourage users to stay active

Improve user onboarding process to enhance engagement and reduce churn

Continuously analyze user behavior data to optimize the app experience and prevent attrition

Conduct regular user surveys to identify pain points and address them promptly

OKRs to grow personal net worth to $1M

ObjectiveGrow personal net worth to $1M

KRInvest 30% of income in high-yield, low-risk opportunities

Allocate funds towards selected investment opportunities

Determine the amount equalling 30% of your yearly income

Research high-yield, low-risk investment options

KRIncrease monthly income by 50% through diversifying income streams

Learn and engage in e-commerce or online business opportunities

Explore and invest in a variety of income generating assets

Start a side job or freelance work related to your skills

KRReduce monthly expenses by 20% through budgeting and disciplined spending

Establish a strict weekly budget and stick to it

Cut out unnecessary expenses such as dining out

Regularly review and adjust spending habits

OKRs to enhance the precision of investment forecasting

ObjectiveEnhance the precision of investment forecasting

KRIncrease the number of successfully predicted trends by 30%

Invest in advanced predictive analytics tools

Conduct more in-depth market research

Hire or train staff in statistical forecasting

KRConduct 3 training workshops on advanced investment analysis techniques

Outline topics and content for the training

Identify appropriate professionals to lead the workshops

Organize location and logistical details

KRImplement AI forecasting tools for 20% reduction in forecast error

Procure and install the selected AI forecasting tools

Train staff on using AI forecasting tools

Identify suitable AI forecasting tools for business needs

OKRs to attract €1m for SAFE investment funding

ObjectiveAttract €1m for SAFE investment funding

KRClose at least 10 investment deals ranging €80,000 - €120,000 each

Identify potential investors interested in €80,000 - €120,000 investments

Negotiate and finalize at least 10 investment deals

Develop a compelling presentation showcasing investment opportunities

KRConduct 40 investor presentations to showcase SAFE investment benefits

Schedule and conduct 40 investor presentations

Identify and compile list of potential investors for presentations

Develop compelling presentation material on SAFE investment benefits

KRIdentify and connect with 100 potential investors with interest in SAFE

Develop a tailored pitch for SAFE investment

Research and list 100 potential SAFE investors

Initiate contact with each identified investor

Investment Team OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

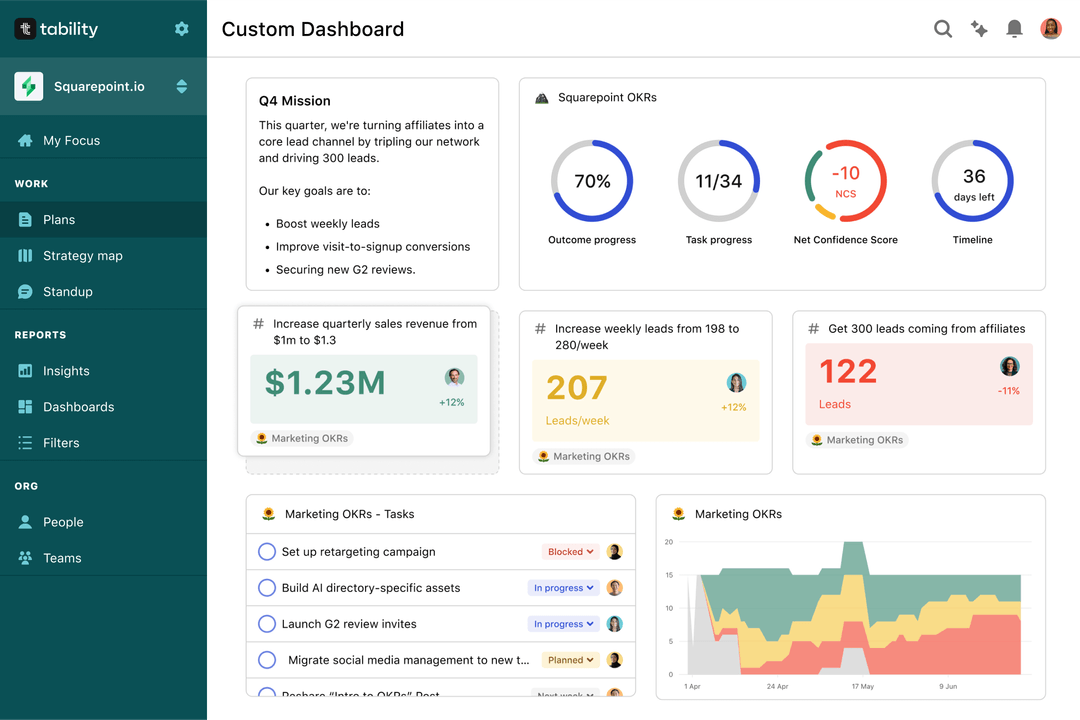

Save hours with automated Investment Team OKR dashboards

OKRs without regular progress updates are just KPIs. You'll need to update progress on your OKRs every week to get the full benefits from the framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Investment Team OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance proficiency in requirements assessment for personal development

OKRs to certify in development using JTA, Blueprint, Item writing & peer reviews

OKRs to enhance our data leak protection solution's market competitiveness

OKRs to improve product quality by ensuring teams identify and mitigate risks

OKRs to broaden visibility and recognition of the brand

OKRs to ensure adequate development of a proficient Project Executive in AI tech