Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Finance OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Finance to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Finance OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

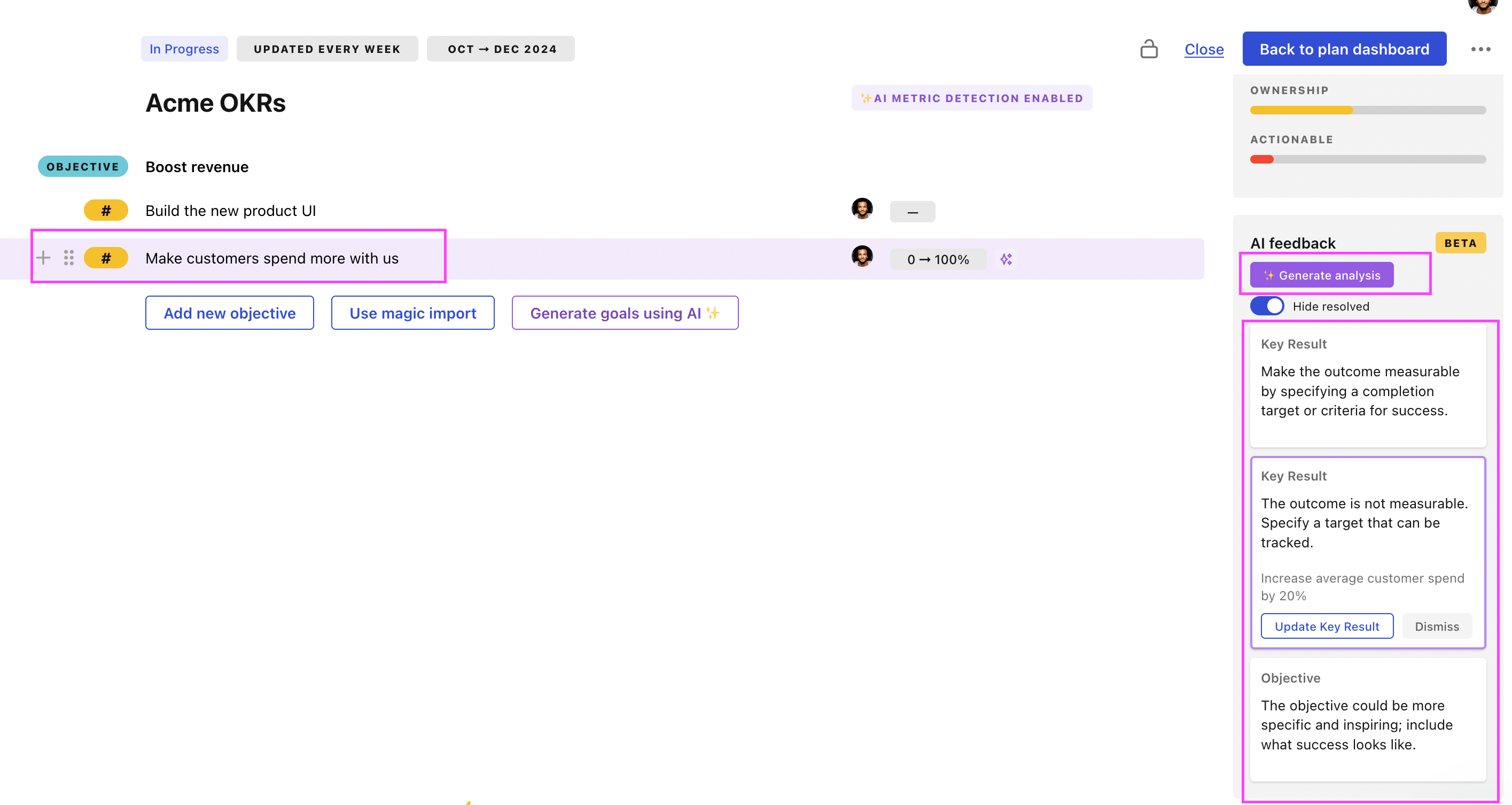

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Finance OKRs examples

You will find in the next section many different Finance Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to enhance leadership skills in the finance department

ObjectiveEnhance leadership skills in the finance department

KRAchieve a 20% increase in leadership competency scores in finance team evaluations

Implement regular feedback sessions to identify improvements

Arrange weekly leadership development workshops for the finance team

Incorporate mentorship programs with experienced leaders

KRImplement a weekly finance-focused leadership workshop for potential leaders

Schedule a consistent time for the weekly meetings

Invite potential leaders to participate in workshops

Identify relevant finance topics for weekly workshops

KRIdentify and mentor 3 high-potential employees for leadership roles

Begin one-on-one mentoring sessions regularly

Identify three employees showing leadership potential

Develop personalized mentorship plans for each

OKRs to enhance accuracy of general ledger amounts to 90%

ObjectiveEnhance accuracy of general ledger amounts to 90%

KRConduct weekly audits of general ledger for accuracy and discrepancy detection

Rectify detected ledger inaccuracies promptly

Review weekly transactions in general ledger

Identify and document any accounting discrepancies

KROrganize bi-weekly ledger accuracy training for the finance team

Schedule and announce the bi-weekly training sessions to finance team

Prepare engaging and comprehensive training materials about ledger accuracy

Define the key topics focussing on ledger accuracy for training sessions

KRImplement a new streamlined ledger management software tool

Identify necessary features for the new ledger management software

Purchase or develop the selected software tool

Train staff on how to use the new software

OKRs to enhance risk management in the finance department

ObjectiveEnhance risk management in the finance department

KRDecrease risk-related financial losses by 15%

Strengthen internal audit procedures

Provide staff training on risk management

Implement regular financial risk assessment strategies

KRDevelop and train staff on 3 new risk mitigation strategies

Identify and outline 3 new risk mitigation strategies

Prepare a comprehensive training program around these strategies

Schedule and conduct training sessions for staff

KRImplement risk assessment tools to identify 20% more financial risks

Choose appropriate risk assessment tools

Train staff on proper tool usage

Monitor and measure effectiveness regularly

OKRs to enhance finance department's risk management initiatives

ObjectiveEnhance finance department's risk management initiatives

KRImplement a comprehensive risk monitoring system by end of quarter

Select appropriate risk monitoring software

Train staff on system usage and reporting

Identify key risk factors for ongoing review

KRAchieve a 20% increase in risk management staff competency through targeted training programs

Develop targeted training programs addressing identified skill gaps

Implement training programs and assess staff competency improvements

Identify specific areas requiring competency improvement in risk management staff

KRReduce operational errors by 25% through improved controls and processes

Evaluate and upgrade existing tools and systems

Implement stricter quality control measures

Conduct regular staff training on operational procedures

OKRs to enhance profitable performance of the finance team

ObjectiveEnhance profitable performance of the finance team

KRImprove the ROI (Return on Investment) by 10% on all key business initiatives

Increase upselling and cross-selling efforts across channels

Identify and eliminate inefficient processes or expenditures

Implement tracking metrics to optimize marketing campaigns

KRIncrease total revenue by 15% in operational areas

Initiate strategies for customer retention and acquisition

Enhance product/service offerings to drive sales

Implement efficiency measures to reduce operational costs

KRCut financial inefficiencies and wastage by 20%

Implement stricter budget control measures

Conduct thorough assessments to find wasteful spending

Train employees on cost efficiency strategies

OKRs to ensure compliance and adaptability of Finance department for long-term success

ObjectiveEnsure compliance and adaptability of Finance department for long-term success

KRIdentify and prioritize areas for automation and digitization within the Finance department

KRImplement updated financial policies and procedures to meet regulatory requirements

Revise and update financial policies and procedures to align with regulatory standards

Conduct a comprehensive review of existing financial policies and procedures

Identify gaps between existing policies and regulatory requirements

Communicate and train employees on the updated financial policies and procedures

KRTrain all Finance department staff on new compliance protocols and best practices

Schedule a training session for all Finance department staff

Conduct role-playing exercises to practice implementing the best practices

Assess the knowledge and understanding of staff through a post-training evaluation

Develop training materials and resources for the new compliance protocols

KRDevelop a roadmap for integrating emerging technologies to future-proof Finance operations

OKRs to instill a high-performance culture in Finance Operations

ObjectiveInstill a high-performance culture in Finance Operations

KRElevate employee job satisfaction rate to 90% via targeted development programs

Initiate regular feedback sessions to identify employee issues and concerns

Implement rewards and recognition system to acknowledge outstanding performance

Develop tailored training programs focusing on employee skill enhancement

KRReduce financial reporting errors by 15% to ensure accuracy

Provide staff with additional training on financial reporting

Adopt automated financial reporting software to minimize manual errors

Implement a double-checking system for all financial reports

KRIncrease department's monthly revenue by 10% through process efficiencies

Identify and eliminate unnecessary processes in the workflow

Train staff on new, streamlined procedures

Implement more efficient, cost-saving technology

OKRs to improve accuracy and timeliness in invoice processing

ObjectiveImprove accuracy and timeliness in invoice processing

KRIncrease on-time payments by 30%

Implement automated reminders for upcoming payment due dates

Offer incentives or discounts for early or on-time payments

Enhance payment procedures for user simplicity and convenience

KRReduce invoice processing errors by 25%

Implement invoice automation software to reduce manual entry

Regularly audit invoices to identify errors

Train staff on accurate invoice processing methods

KRDecrease invoice processing time by 20%

Train staff in efficient invoice management techniques

Implement automated invoicing software to speed up processing

Streamline invoice approval workflow to minimize delays

OKRs to maintain financial health by sticking to budget

ObjectiveMaintain financial health by sticking to budget

KRIncrease savings by 10% through efficient budget allocation

Allocate income towards high-interest savings accounts

Identify and cut unnecessary expenditures from personal budget

Regularly review and adjust budget for efficiency

KRAchieve zero budget overruns in all spending categories

Monitor all expenses regularly and adjust promptly

Provide training for effective budget management

Implement strict financial controls and budget limits

KRReduce discretionary spending by 15% compared to last quarter

Identify non-essential expenses from last quarter

Define a strict budget on discretionary items

Implement expenditure tracking and control methods

OKRs to implement an AI tool for efficient user manual generation

ObjectiveImplement an AI tool for efficient user manual generation

KRSecure funding for AI investment by increasing budget 20%

Create a detailed proposal highlighting AI's potential returns

Collaborate with finance team for budget reallocation suggestions

Pitch the revised budget plan to decision-makers

KRIncrease user manual production speed by 50% using the newly implemented AI tool

Prioritize AI-assisted content editing to enhance efficiency

Utilize AI tool for automatic content generation for user manuals

Implement regular staff training on AI tool usage

KRTrain team on AI tool usage, resulting in 30% less time spent drafting

Implement regular practice sessions to reinforce learning

Establish a progress monitoring system for tool proficiency

Schedule AI tool training sessions for all team members

Finance OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

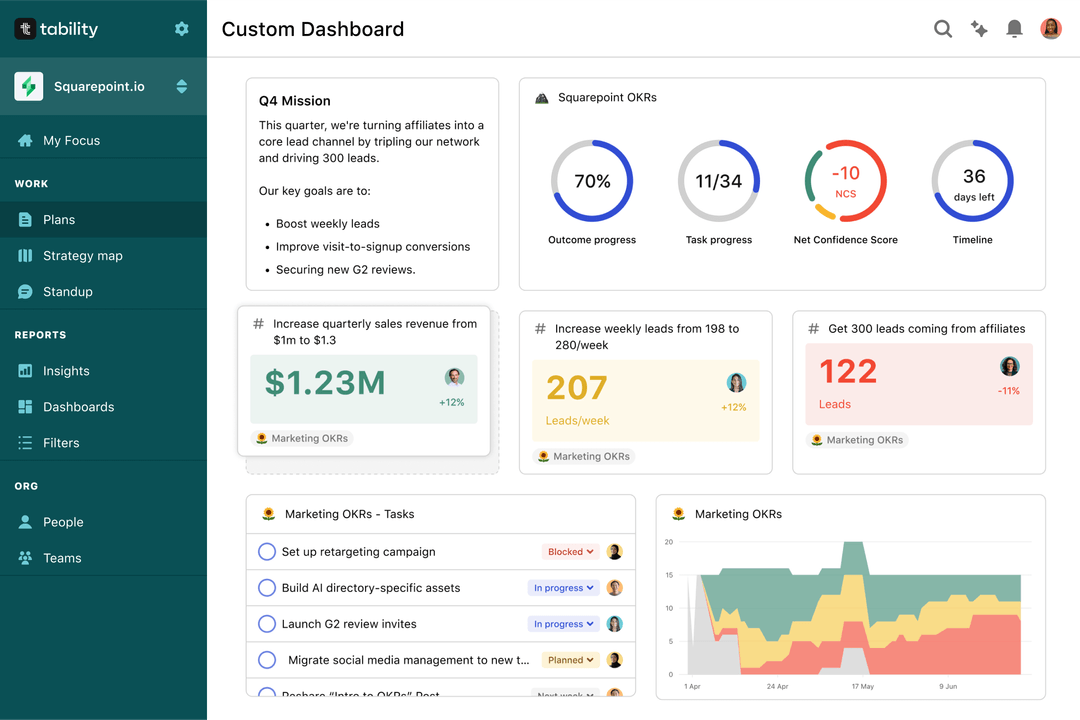

Save hours with automated Finance OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Finance OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to successfully integrate new technology into the electrical grid

OKRs to efficiently manage and optimize our team's budget performance

OKRs to achieve zero loss time accidents

OKRs to enhance IT operational efficiency through data-driven innovations

OKRs to enhance internal controls for a zero-deficiency internal audit

OKRs to enhance talent acquisition and retention strategies