Tability is a cheatcode for goal-driven teams. Set perfect OKRs with AI, stay focused on the work that matters.

What are Fintech OKRs?

The OKR acronym stands for Objectives and Key Results. It's a goal-setting framework that was introduced at Intel by Andy Grove in the 70s, and it became popular after John Doerr introduced it to Google in the 90s. OKRs helps teams has a shared language to set ambitious goals and track progress towards them.

Crafting effective OKRs can be challenging, particularly for beginners. Emphasizing outcomes rather than projects should be the core of your planning.

We've tailored a list of OKRs examples for Fintech to help you. You can look at any of the templates below to get some inspiration for your own goals.

If you want to learn more about the framework, you can read our OKR guide online.

The best tools for writing perfect Fintech OKRs

Here are 2 tools that can help you draft your OKRs in no time.

Tability AI: to generate OKRs based on a prompt

Tability AI allows you to describe your goals in a prompt, and generate a fully editable OKR template in seconds.

- 1. Create a Tability account

- 2. Click on the Generate goals using AI

- 3. Describe your goals in a prompt

- 4. Get your fully editable OKR template

- 5. Publish to start tracking progress and get automated OKR dashboards

Watch the video below to see it in action 👇

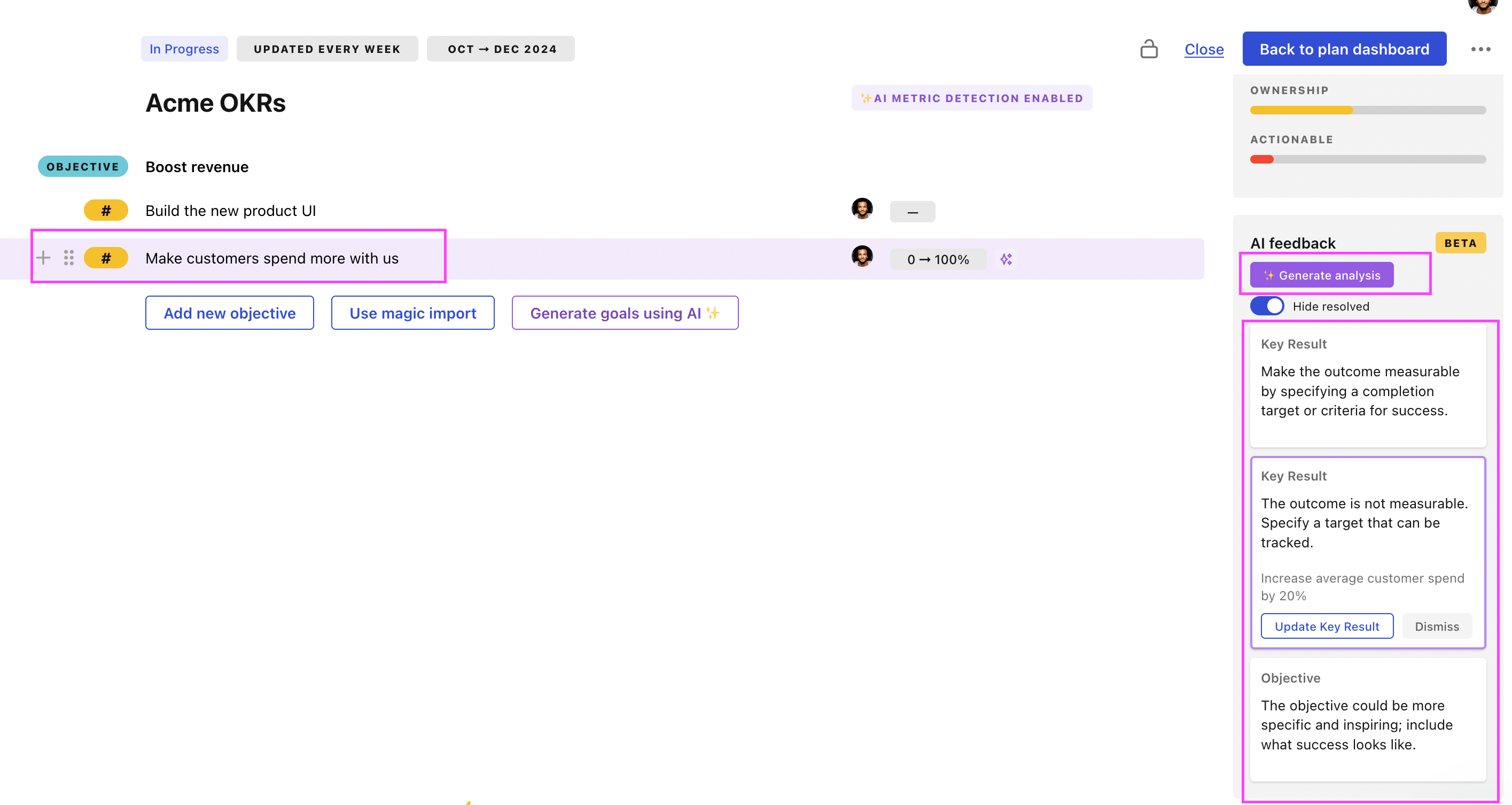

Tability Feedback: to improve existing OKRs

You can use Tability's AI feedback to improve your OKRs if you already have existing goals.

- 1. Create your Tability account

- 2. Add your existing OKRs (you can import them from a spreadsheet)

- 3. Click on Generate analysis

- 4. Review the suggestions and decide to accept or dismiss them

- 5. Publish to start tracking progress and get automated OKR dashboards

Tability will scan your OKRs and offer different suggestions to improve them. This can range from a small rewrite of a statement to make it clearer to a complete rewrite of the entire OKR.

Fintech OKRs examples

You will find in the next section many different Fintech Objectives and Key Results. We've included strategic initiatives in our templates to give you a better idea of the different between the key results (how we measure progress), and the initiatives (what we do to achieve the results).

Hope you'll find this helpful!

OKRs to author comprehensive ADRs for Google Cloud Platform at FinTech company

ObjectiveAuthor comprehensive ADRs for Google Cloud Platform at FinTech company

KRGet ratification on drafted ADRs from 90% of the architectural committee

Secure ratification from at least 90% of members

Distribute drafted ADRs to architectural committee members

Schedule deliberation meetings to discuss ADRs

KRDraft and finalize 10 substantive ADRs by measuring quality and completeness

Write initial drafts incorporating identified points

Finalize edits and review for quality and completeness

Identify key points needed in 10 substantive ADRs

KRImprove ADRs based on feedback with less than 10% revisions needed

Encourage peer review for immediate corrective actions

Regularly review and correct ADRs consistently

Implement feedback into ADR creation process promptly

OKRs to launch fintech product successfully

ObjectiveLaunch fintech product successfully

KROnboard and acquire a minimum of 1000 active users for the fintech product

Implement referral program offering incentives to existing users for inviting new sign-ups

Identify target audience and create detailed user personas for effective marketing strategies

Develop a user-friendly onboarding process with intuitive interface and seamless experience

Launch targeted digital marketing campaigns to attract and engage potential users

KRDevelop and implement a robust backend system that supports the fintech product

Identify key features and requirements for the robust backend system

Test and deploy the backend system, ensuring its functionality and scalability

Conduct thorough research on existing backend systems in the fintech industry

Collaborate with IT team to design and develop the backend system architecture

KRConduct thorough testing and ensure the fintech product meets all functional requirements

Execute the test plan, meticulously examining each aspect of the product's functionality

Develop a comprehensive test plan covering all functional requirements of the fintech product

Document any issues or discrepancies encountered during the testing process for further analysis

Continuously retest the product after resolving issues to ensure functional requirements are met

KRAchieve at least 90% customer satisfaction rate through user feedback and surveys

Implement a user feedback system to collect customer opinions and suggestions regularly

Monitor and track customer satisfaction rate through ongoing feedback and surveys

Analyze the data from user feedback and surveys to identify areas for improvement

Develop and implement strategies based on user feedback to address customer concerns and enhance satisfaction

OKRs to enhance visibility and effectiveness of Fintech marketing operations

ObjectiveEnhance visibility and effectiveness of Fintech marketing operations

KRIncrease conversion rates by 25% through optimization of marketing funnels

Analyze current marketing funnel for potential improvements

Implement A/B testing strategies on landing pages

Enhance user experience and navigation on the website

KRSecure 10 new high-value partnerships for cooperative marketing ventures

Develop tailored partnership proposals

Identify potential partners in target market

Initiate engagement and negotiations

KRBoost website traffic by 30% with strategic SEO and content marketing

Develop valuable, SEO-optimized content

Monitor and analyze website traffic data regularly

Research relevant keywords for strategic SEO implementation

OKRs to boost transaction count and customer base for Fintech Wallet App

ObjectiveBoost transaction count and customer base for Fintech Wallet App

KRImprove customer retention rate by 10%

Implement a loyalty rewards program for frequent customers

Personalize email marketing content targeting existing customers

Enhance customer service training to handle complaints efficiently

KRGrow transaction volume per user by 20%

Introduce loyalty programs to incentivize repeat purchases

Promote upselling and cross-selling initiatives

Improve user experience to streamline transaction process

KRIncrease weekly active users by 15%

Improve user interface for better user experience

Implement a marketing campaign focusing on user benefits

Conduct user engagement surveys to identify improvement areas

Fintech OKR best practices

Generally speaking, your objectives should be ambitious yet achievable, and your key results should be measurable and time-bound (using the SMART framework can be helpful). It is also recommended to list strategic initiatives under your key results, as it'll help you avoid the common mistake of listing projects in your KRs.

Here are a couple of best practices extracted from our OKR implementation guide 👇

Tip #1: Limit the number of key results

The #1 role of OKRs is to help you and your team focus on what really matters. Business-as-usual activities will still be happening, but you do not need to track your entire roadmap in the OKRs.

We recommend having 3-4 objectives, and 3-4 key results per objective. A platform like Tability can run audits on your data to help you identify the plans that have too many goals.

Tip #2: Commit to weekly OKR check-ins

Don't fall into the set-and-forget trap. It is important to adopt a weekly check-in process to get the full value of your OKRs and make your strategy agile – otherwise this is nothing more than a reporting exercise.

Being able to see trends for your key results will also keep yourself honest.

Tip #3: No more than 2 yellow statuses in a row

Yes, this is another tip for goal-tracking instead of goal-setting (but you'll get plenty of OKR examples above). But, once you have your goals defined, it will be your ability to keep the right sense of urgency that will make the difference.

As a rule of thumb, it's best to avoid having more than 2 yellow/at risk statuses in a row.

Make a call on the 3rd update. You should be either back on track, or off track. This sounds harsh but it's the best way to signal risks early enough to fix things.

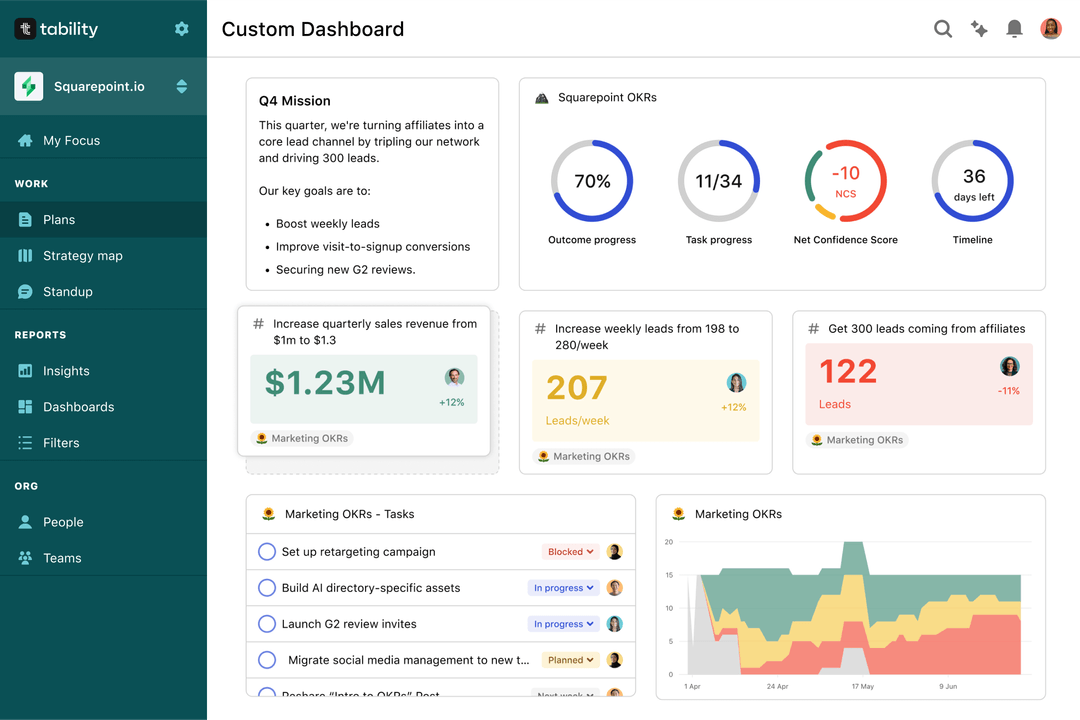

Save hours with automated Fintech OKR dashboards

Your quarterly OKRs should be tracked weekly if you want to get all the benefits of the OKRs framework. Reviewing progress periodically has several advantages:

- It brings the goals back to the top of the mind

- It will highlight poorly set OKRs

- It will surface execution risks

- It improves transparency and accountability

Spreadsheets are enough to get started. Then, once you need to scale you can use Tability to save time with automated OKR dashboards, data connectors, and actionable insights.

How to get Tability dashboards:

- 1. Create a Tability account

- 2. Use the importers to add your OKRs (works with any spreadsheet or doc)

- 3. Publish your OKR plan

That's it! Tability will instantly get access to 10+ dashboards to monitor progress, visualise trends, and identify risks early.

More Fintech OKR templates

We have more templates to help you draft your team goals and OKRs.

OKRs to enhance QA analysis of each MCSS in the test repository

OKRs to boost community membership and customer conversion

OKRs to increase customer acquisition and boost account productivity

OKRs to achieve a pass grade above 70 in all subjects

OKRs to develop a cloud-based SAAS loyalty product

OKRs to boost overall delivery speed by 10%